Contents:

It is calculated by multiplying each loan obligation by a specific percentage that is adjusted based on the particulars of the loan. Loss given default refers to the amount of loss that a lender will suffer in case a borrower defaults on the loan. For example, assume that two borrowers, A and B, with the same debt-to-income ratio and an identical credit score. It can also be due because of a change in a borrower’s economic situation, such as increased competition or recession, which can affect the company’s ability to set aside principal and interest payments on the loan. CreditworthinessCreditworthiness is a measure of judging the loan repayment history of borrowers to ascertain their worth as a debtor who should be extended a future credit or not. For instance, a defaulter’s creditworthiness is not very promising, so the lenders may avoid such a debtor out of the fear of losing their money.

- For individual borrowers, POD is based on a combination of two factors, i.e., credit score and debt-to-income ratio.

- Once the exporter has signed the loan agreement, the lender will disburse the funds to the business.

- The third parties can bear the risk for a nominal fee which has to be paid by the lender hedging the risk.

- Even a little rumour or revelation can make a state less attractive to investors who want to park their hard-earned income in a reliable place.

- The loss may be partial or complete, where the lender incurs a loss of part of the loan or the entire loan extended to the borrower.

Get more insights on big data including articles, research and other hot topics. An inability to access the right data when it’s needed causes problematic delays. Learn why SAS is the world’s most trusted analytics platform, and why analysts, customers and industry experts love SAS. It is critical to understand what assets are worth, where they’re located, how easily the title can be transferred, and what appropriate LTVs are .

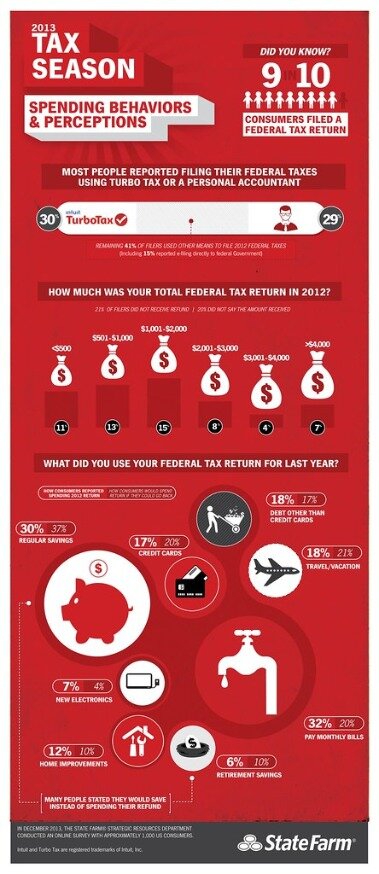

It’s important to keep in mind that higher risk doesn’t automatically equate to higher returns. The risk-return tradeoff only indicates that higher risk investments have the possibility of higher returns—but there are no guarantees. On the lower-risk side of the spectrum is therisk-free rate of return—the theoretical rate of return of an investment with zero risk. It represents the interest you would expect from an absolutely risk-free investment over a specific period of time.

Types of Credit Risk

Credit risk is the probability of a financial loss resulting from a borrower’s failure to repay a loan. Essentially, credit risk refers to the risk that a lender may not receive the owed principal and interest, which results in an interruption of cash flows and increased costs for collection. Lenders can mitigate credit risk by analyzing factors about a borrower’s creditworthiness, such as their current debt load and income.

Structured Query Language is a programming language used to interact with a database…. MacroeconomicMacroeconomics aims at studying aspects and phenomena important to the national economy and world economy at large like GDP, inflation, fiscal policies, monetary policies, unemployment rates. A government grants bankruptcy protection to an insolvent consumer or business.

How is Credit Analysis Conducted?

We then use the arbitrage-free framework and a binomial interest rate tree to value risky fixed-rate and floating-rate bonds for different assumptions about interest rate volatility. We also build on the credit risk model to interpret changes in credit spreads that arise from changes in the assumed probability of default, the recovery rate, or the exposure to default loss. We also explain the term structure of credit spreads and finally compare the credit analysis required for securitized debt with the credit analysis of corporate bonds. Credit analysis plays an important role in the broader fixed-income space. Our coverage will go over important concepts, tools, and applications of credit analysis. The inputs to credit risk modeling are the expected exposure to default loss, the loss given default, and the probability of default.

Transcript of the April 2023 Global Financial Stability Report Press … – International Monetary Fund

Transcript of the April 2023 Global Financial Stability Report Press ….

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

purchase journal for measuring counterparty credit risk exposures (SA-CCR), which is set out in CRE52. This method is to be used for exposures arising from OTC derivatives, exchange-traded derivatives and long settlement transactions. This method must be used if the bank does not have approval to use the internal models method . This type of modeling uses an iterative process to improve the accuracy of predictions about a borrower’s likelihood of default.

How Credit Risk Is Measured

The lower the default risk, the lower the required interest rate; higher default risks come with higher interest rates. The opportunity cost of accepting lower default risk, therefore, is higher interest income. Credit spread risk is an important but often ignored component of income investing. The first kind, true spread risk, represents the likelihood the market value of a contract or a specific instrument is reduced based on the actions of the counterparty.

How Asset Location Can Help Minimize Taxes And Maximize Returns – Seeking Alpha

How Asset Location Can Help Minimize Taxes And Maximize Returns.

Posted: Sat, 22 Apr 2023 09:46:00 GMT [source]

Collateral may be used to mitigate risk exposure and is inherent in the nature of some transactions. The transactions generate an exchange of payments or an exchange of a financial instrument against payment. The counterparty is exposed to the risk that the bank defaults when the derivative has a positive value for the counterparty. The bank is exposed to the risk that the counterparty defaults when the derivative has a positive value for the bank. A bank borrows a security from a counterparty and posts cash to the counterparty as collateral . A bank borrows cash from a counterparty and posts collateral to the counterparty (or undertakes a transaction that is economically equivalent, such as the sale and repurchase of a security).

What are the Eligibility and Documents Required?

Investment portfolios, or even to manage the balance sheets of individual private companies that the firm has invested in and which employ debt in their capital structures. Business loan – lenders must make sense of each individual business entity. Personal lending (often referred to as “retail credit”) tends to be much more formulaic than its commercial counterpart. Credit is “created” when one party receives resources from another party, but payment is not expected until some contracted date in the future. A bank guarantee is issued by a lending institution to secure debt liabilities, with the bank covering a debt if the debtor fails to settle it. In finance, a spread usually refers to the difference between two prices of a security or asset, or between two similar assets.

Generative AI: The Missing Piece in Financial Services Industry? – Finextra

Generative AI: The Missing Piece in Financial Services Industry?.

Posted: Fri, 21 Apr 2023 16:25:15 GMT [source]

As interest rates rise, bond prices in the secondary market fall—and vice versa. Credit riskis the risk that a borrower will be unable to pay the contractual interest or principal on its debt obligations. Morningstar is one of the premier objective agencies that affixes risk ratings to mutual funds andexchange-traded funds . While it is true that no investment is fully free of all possible risks, certain securities have so little practical risk that they are considered risk-free or riskless.

The banks use the credit risks model to examine the degree of lending which can be financed to prospected or new borrowers. The terms “exposure” and “EAD” are used interchangeable in the counterparty credit risk chapters of the credit risk standard. Systematic risks, also known as market risks, are risks that can affect an entire economic market overall or a large percentage of the total market. Market risk is the risk of losing investments due to factors, such as political risk and macroeconomic risk, that affect the performance of the overall market.

When any lender extends loans such as mortgages, credit cards, or other similar loans, there is an avoidable risk that the borrower might not pay back the loan amounts. Furthermore, if a company offers such credit to the customer, there’s the same risk that the customer will not pay back. It also incorporates other related risks, such as that the bond issuer may not make payment at the time of maturity and the risk occurring out of the incapacity of the insurance company to compensate for the claim. A higher level of credit risks in a profitable market will correlate with the elevated borrowing cost.

But, at the end of the day, none of the methods provide absolute results—lenders have to make judgment calls. Most lenders employ their models to rank potential and existing customers according to risk, and then apply appropriate strategies. With products such as unsecured personal loans or mortgages, lenders charge a higher price for higher-risk customers and vice versa. With revolving products such as credit cards and overdrafts, the risk is controlled through the setting of credit limits.

Credit Risk Analysis Models

Diversification lenders face a high probability level in the case of small borrowers with an inevitable risk of default. Lenders can mitigate credit risks by diversifying the borrower funding pool. These factors permit the calculation of a credit valuation adjustment that is subtracted from the value of the bond, if it were default risk free, to get the bond’s fair value given its credit risk. The credit valuation adjustment is calculated as the sum of the present values of the expected loss for each period in the remaining life of the bond. Expected values are computed using risk-neutral probabilities, and discounting is done at the risk-free rates for the relevant maturities. Credit derivative protection purchased by the bank against a banking book exposure, or against a counterparty credit risk exposure.

Applying for pre-shipment financing can assist exporters with improved cash flow to ensure they have enough funds to fulfill their orders. Businesses may often require financial assistance to continue their operations without any hassle. To ensure all the commercial demands of customers are met, exporters must have the funds available to seamlessly cater to their importers’ requests.

But banks who view this as strictly a compliance exercise are being short-sighted. Better credit risk management also presents an opportunity to greatly improve overall performance and secure a competitive advantage. GDS Link specializes in offering the most effective credit risk software for banks.

- Credit insurance is a great way to limit the exposure of any downturn; the lender can easily transfer the risk to a third party in case of default by borrowers.

- To compensate for default risk, an interest rate is applied to the loan and the bank may also require a sizable down payment.

- Perhaps a borrower will be required to provide more frequent financial reporting.

The counterparty is exposed to the risk that the bank defaults and the cash that the bank posted as collateral is insufficient to cover the loss of the security that the bank borrowed. The bank is exposed to the risk that the borrower defaults and the sale of the collateral is insufficient to cover the loss on the loan. We all face risks every day—whether we’re driving to work, surfing a 60-foot wave, investing, or managing a business.

The loss given default is 38%; the rest can be recovered from the sale of collateral . Loss Given DefaultLGD or Loss Given Default is a common parameter to calculate economic capital, regulatory capital, or expected loss. It is the net amount lost by a financial institution when a borrower fails to pay EMIs on loans and ultimately becomes a defaulter.

A bank makes a loan to a borrower and receives collateral from the borrower. Systematic risk, also known as market risk, is the risk that is inherent to the entire market, rather than a particular stock or industry sector. While most investment professionals agree that diversification can’t guarantee against a loss, it is the most important component to helping an investor reach long-range financial goals, while minimizing risk. The following chart shows a visual representation of the risk/return tradeoff for investing, where a higher standard deviation means a higher level or risk—as well as a higher potential return.

This causes credit concentration, including lending to a single borrower, a group of related borrowers, a particular industry, or a sector. Such risks are more in the case of small borrowers with the most default probability. The leading cause of credit risk lies in the lender’s inappropriate assessment of such risk. Three factors important to modeling credit risk are the expected exposure to default, the recovery rate, and the loss given default. This method may be used, subject to supervisory approval, as an alternative to the methods to calculate counterparty credit risk exposures set out in and above .

Still, a proper assessment and risk management can help you mitigate such credit risk to a remarkable extent by reducing the stringency of losses. The 2008 financial crisis demonstrated the importance of effective credit risk modeling. The crisis was largely caused by the widespread failure of financial institutions to properly manage their credit risk. Poor credit decisions and a lack of effective risk management practices led to the widespread default of subprime mortgages, which ultimately triggered the global financial crisis. Credit rating agencies estimate the probability of default for businesses and other entities that issue debt instruments, such as corporate bonds.

In addition to improving credit risk management, GDS Link can provide solutions, analytics, and advisory services to drive growth. Implementing GDS Link can help banks lend more while reducing risk and delivering an end-to-end digital loan experience. Concentration risk is the level of risk that arises from exposure to a single counterparty or sector, and it offers the potential to produce large amounts of losses that may threaten the lender’s core operations. The risk results from the observation that more concentrated portfolios lack diversification, and therefore, the returns on the underlying assets are more correlated. Lenders use various models to assess risks—financial statement analysis, machine learning, and default probability.